For such an important business function, small business accounting divides the world of business owners into two groups: those who LIKE accounting and those who CAN’T STAND accounting.

In this easy-to-remember accounting guide, we’ll highlight the most important terminology that you need to know and make accounting easier for all small business owners in Canada.

This list will either be a review (for the savvy accountants) or a tool to help you communicate with your bookkeeper/accountant or accounting firm (for the operations-focused business owners).

Important Accounting Terms For Small Business Owners In Canada

Here is a list of the most important accounting terms you need to know:

Accounting Software

Accounting software is a computer program that helps record, process, and automates various accounting and bookkeeping tasks.

Modern accounting software can be used to create and send invoices, track sales, and expenses and prepare financial reports.

Most small business software in Canada is connected to the internet and can integrate with payment providers, credit cards, payroll, and other important business operations that require sending and receiving money.

Accounts Payable

Accounts payable (AP) is an account that represents the short-term obligations of a business (how much money it owes creditors or suppliers).

The accounts payable line item shows up on the balance sheet as a liability and refers to the money owed for goods and services that a business has received, but not yet paid for.

Accounts Receivable

Accounts receivable (AR) is an account that represents the short-term obligations owed to a business by customers and clients who made purchases using credit (not cash).

The accounts receivable line shows up on the balance sheet as an asset and is usually converted to cash within a 12-month period.

Accrual Basis Accounting

The accrual basis of accounting is a method of recognizing revenues and expenses as they are incurred. This is different than the cash basis of accounting which recognizes revenues and expenses when cash is received or spent.

Accrual accounting is used to smooth the revenues and expenses of a business which makes the operations of a business easier to understand at a high level.

The accrual basis of accounting is accepted under both GAAP (generally accepted accounting principles) and IFRS (international financial reporting standards).

Assets

An asset is a resource that is owned or controlled by a business. Assets include cash, buildings, intellectual property, and many other items.

Assets are grouped into 2 categories: tangible assets (real assets) and intangible assets (no-physical assets).

Tangible assets are further broken down into short-term assets (current assets) and long-term assets (fixed assets).

Balance Sheet

The balance sheet is one of the 3 most important financial statements and communicates the “book value” of a business.

The three key sections of a balance sheet are:

- Assets (what the business owns)

- Liabilities (what the business owes)

- Owners Equity (net worth of the business)

Business owners and stakeholders use the balance sheet to determine the value and health of a company at a specific moment in time.

Cash flow statement

The cash flow statement is another of the three most important financial statements and shows the inflows and outflows of cash over a given period (monthly, quarterly, semi-annually) of a business.

The cash flow statement is broken down into three sections:

- Operating activities

- Investing activities

- Financing activities

Cash flow is the lifeblood of a business and so business owners need to manage the cash inflows and outflows carefully or risk default.

Cost of goods sold

The cost of goods sold (COGS) is the direct costs associated with producing the goods or services that a business sells.

COGS includes the cost of materials, labour, and any other direct expenses associated with producing the good or service.

COGS does not include indirect expenses such as marketing, administrative, or overhead costs.

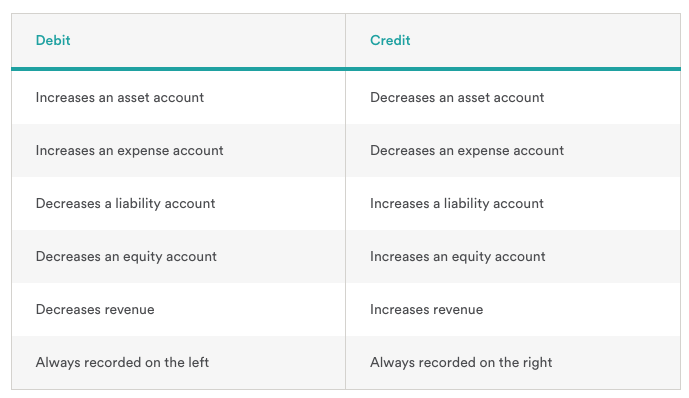

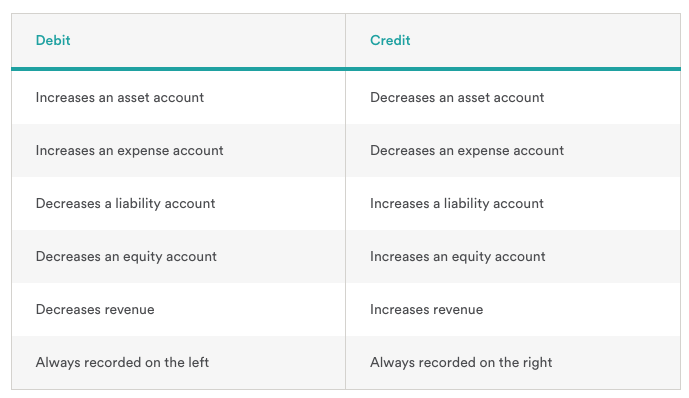

Credit

The term “credit” has several meanings when it comes to the language of accounting.

Primary, a credit is an accounting entry that records a decrease in assets (and a decrease in expenses) or an increase in liabilities (and an increase in revenue).

Also, credit is created (extended) when suppliers sell their products or services but don’t require payment until a later date.

Debit

A debit is the opposite of a credit.

A debit is an accounting entry that records an increase in assets (and an increase in expenses) or a decrease in liabilities (and a decrease in revenue).

Here is a cheat sheet on debits and credits from Bench:

Source: https://bench.co/blog/bookkeeping/debits-credits/

Depreciation

Depreciation is a way to measure the useful life of an asset (vehicle, building, computer) and smooth the related expense of that asset over multiple years of a business’s operations.

Depreciation relates to long-term assets (fixed assets).

Depreciation is an expense item on the income statement.

Dividends

A dividend is a legal/accounting term used to define the distribution of cash from a business to its owner.

Dividends received by an individual are subject to tax by their local tax authority.

Equity (owner’s equity)

Owners’ equity (which in accounting is different than when people use “equity” as a synonym for “stock”) is the net worth of a business and is calculated by subtracting the total liabilities of a business from the total assets of a business.

Equity is a measure of the “book value” of a business and might differ from the actual value that you can sell that business for or liquidate the business at.

Expenses

An expense is defined as any cost incurred in the operation of a business.

Expenses are classified as either direct or indirect.

Direct expenses are easily traced back to the specific product or service being sold and classified as the cost of goods sold (COGS).

Indirect expenses cannot be directly linked to a single product or service but are still necessary for the operation of the business. Items like technology, rent, salaries, and marketing are all indirect expenses and classified as operating expenses.

General ledger (GL)

The general ledger is the primary accounting record for a business and contains all the financial transactions of a business over its lifetime.

The general ledger can be divided into two types of accounts: personal and real.

Personal accounts are for individuals, and real accounts are for businesses.

Generally Accepted Accounting Principles (GAAP)

GAAP is a set of standards and guidelines for financial reporting.

It includes concepts like the double-entry bookkeeping system, accrual basis accounting, and the matching principle.

Adhering to GAAP ensures that financial statements are accurate and comparable across businesses.

Income statement

The income statement is the third of the 3 most important financial statements.

Also called the profit and loss statement, it is the financial statement that shows a company’s revenue, expenses, and net income over a period of time.

The income statement can be prepared on a monthly, quarterly, or annual basis.

Liability

A liability is an obligation of a business to its creditors.

Liabilities can be either current or long-term.

Current liabilities are obligations that are due within one year, while long-term liabilities are due after one year.

Items like accounts payable are current liabilities while any long-term debt would be considered a long-term liability.

Net income

Net income is the total revenue of a business minus the total expenses of a business.

It is also called the bottom line because it is typically the last line item on an income statement.

Net income can be positive (meaning the business made money) or negative (meaning the business lost money).

Profit and loss statement (P&L)

The profit and loss statement is another name for the third of the 3 most important financial statements.

Also called the income statement, it is the financial statement that shows a company’s revenue, expenses, and net income over a period of time.

The P&L can be prepared on a monthly, quarterly, or annual basis.

Revenue

Revenue (sales) is the total amount of money a business brings in through its operations.

It is generated through the sale of goods or services and is typically recorded on the top line of an income statement.

Gross revenue is the total amount of money earned before any expenses (after COGS).