Canadian small business owners can save hours of tedious spreadsheet work by using accounting software in Canada to manage their books. Also, tasks like tracking receivables and payables, understanding financial metrics, and prepping for tax season become much easier.

While there are many different types of accounting software to choose from, I have put together a list of the best accounting software when comparing price, features, ease of use, integrations, scalability, and industry best practices.

What is Accounting Software?

Accounting software is either cloud-based or local software that allows business owners to enter, track and report their financial data. Most accounting software in Canada is advanced enough to be used for tax reporting and robust enough to integrate with most outside accounting firms’ systems.

Accounting software has the following features:

- Bookkeeping

- Creating financial statements

- Financial reporting

- Managing accounts

- Productivity enhancements

- Getting data for tax filing

Most free software do not have the full suite of business tools needed to run a small business but all of the online accounting software featured have a free option to test out their accounting features.

Choosing good accounting software is important for Canadian businesses because it can free up a lot of time for the entrepreneur or manager to focus on strategy and increasing revenues.

The 5 Best Accounting Software in Canada for Small Business

Here is our list of the best accounting software in Canada for Small Business:

- QuickBooks Online

- Freshbooks

- Xero

- Wave

- Sage Business Cloud Accounting

Keep reading for a detailed review of each accounting software.

Best Accounting Software Canada Review

1. QuickBooks Online

QuickBooks Online is one of the oldest and most commonly used accounting software by small businesses for bookkeeping and integration with tax experts. It is cloud-based and can be accessed through a browser or a mobile app.

QuickBooks is owned by Intuit which also owns TurboTax (tax preparation software) and Mint (a personal financial app).

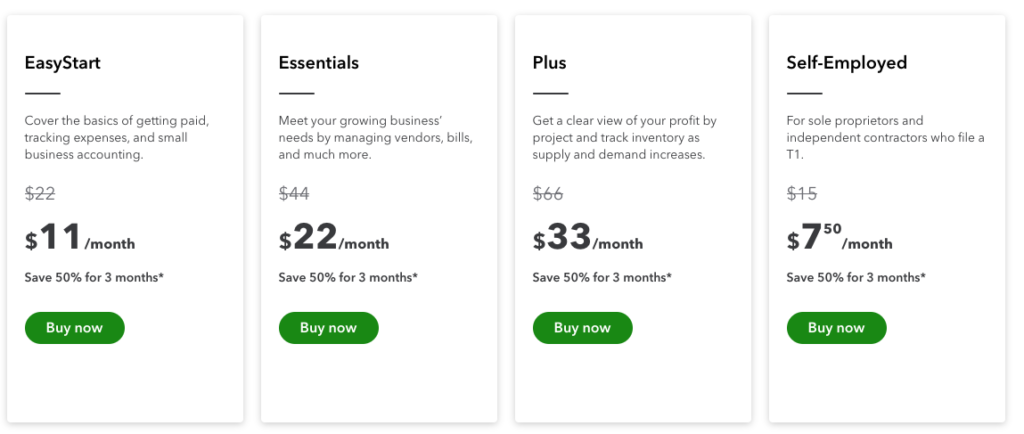

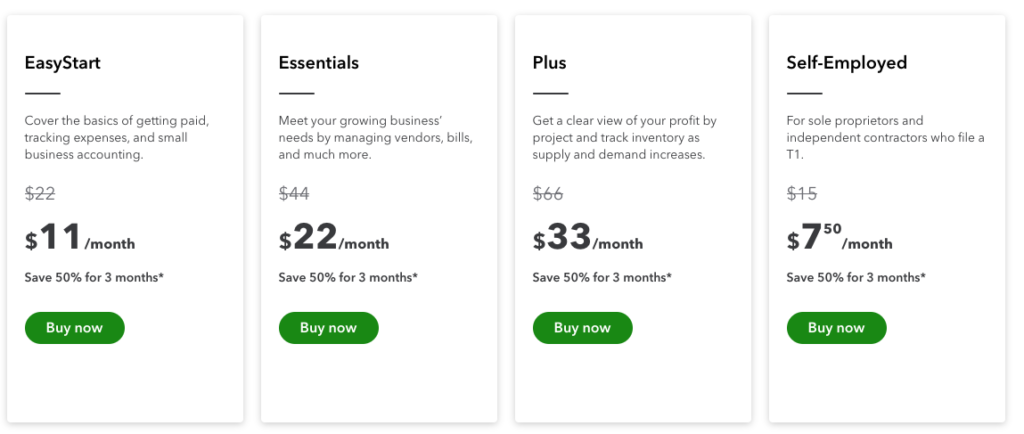

The QuickBooks Online essentials package ($22/month) includes:

- Receipt scanning

- Financial reports

- Expense tracking

- Online payments integrations

- Accounting system

Some advanced features of the QuickBooks online accounting software are:

- Payment reminders for bills

- Professional invoices

- Payroll solutions

There are a variety of plans to match the needs of various sized small businesses or sole proprietors. Also, each plan integrates with third-party apps like Stripe and PayPal which is extremely helpful for online business owners.

A subscription may be upgraded as a company expands, and the mobile app offers several customization options for receiving payments, reading reports, taking a picture of a receipt, and tracking business miles.

In addition, QuickBooks Payroll is fully integrated with QuickBooks Online.

This cloud-based accounting software takes the top spot for best overall accounting software because of the robust and scalable features, reasonable price, and the fact that it is commonly used by accounting professionals who support small business owner operations.

Learn more about QuickBooks Online pricing here.

2. FreshBooks

FreshBooks is a very user-friendly accounting software program that is also cloud-based. It was created in 2004 in Tronto and is one of the most popular Canadian accounting software companies.

Small business owners will appreciate how FreshBooks small business accounting software supports specific Canadian tax calculations.

The FreshBooks Plus package ($12.80/month) includes:

- Unlimited invoices for up to 50 clients

- Automatic expense tracking

- Recurring billing

- Create invoices and send invoices

- Standard accounting functions

The plus package is great for small business owners who want to automate their bookkeeping and reporting functions but who don’t yet need accounts payable and accounts receivable automation or the ability to track the profitability of different projects.

Also, FreshBooks offers plans with advanced accounting features for larger businesses:

- Accept online payments

- Customer relationship management for users

- Help to migrate from other software

Overall, FreshBooks is a powerful accounting software at a small business cost. The platform has an intuitive double-entry accounting system and very good small business accounting software.

3. Xero

Xero is another great accounting software for small businesses in Canada and has over 3 million subscribers.

The company is based in New Zealand and differentiates itself from other accounting software by offering unlimited users to their accounts with any level of subscription.

Management of business finances and bank accounts is easy with Xero and their software solves most accounting needs including:

- Invoice services

- Managing business expenses

- Easy data entry

- Accounts payable and accounts receivable management

- Cash management (cash flow analysis)

Xero offers 24/7 online support but it does not offer customer service over the phone. This can be fine for some small businesses but a problem if you need a quick answer to a detailed question.

The premium plan features a more comprehensive accounting system with the following add-ons:

- Multiple currencies

- Business performance analytics

- Project management and tracking

Check out Xero if you appreciate an easy-to-use accounting tool that has all the functionality needed to support small businesses.

4. Wave

The founders of Wave believe small businesses are the heart of our communities and have designed their accounting software with SMB owners in mind.

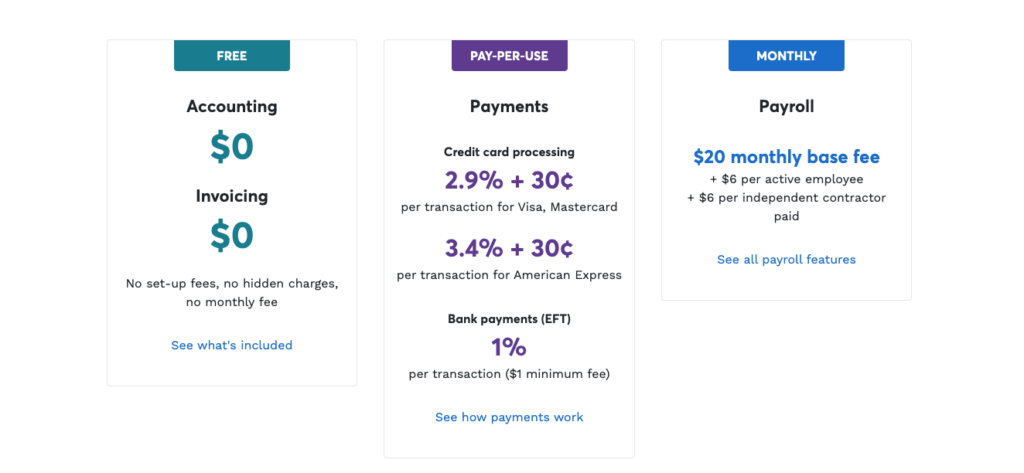

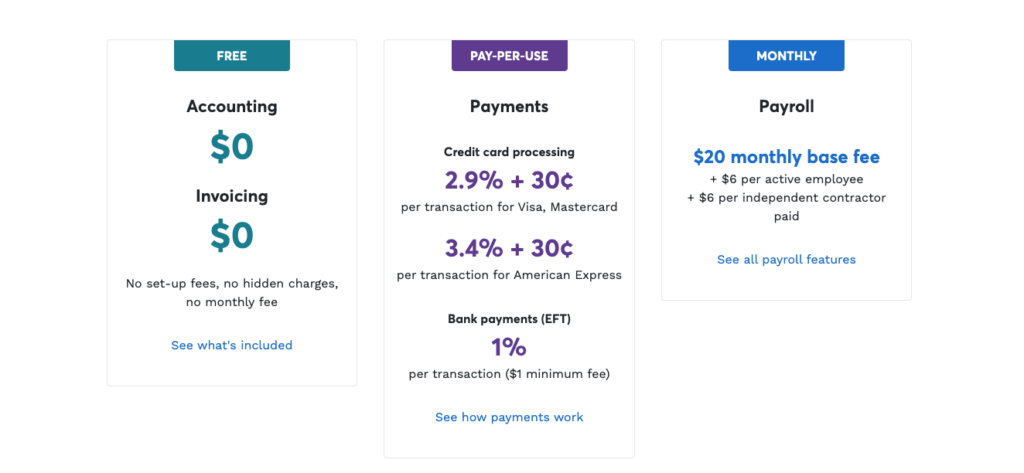

Unlike other accounting and invoicing services, Wave offers free software to cover basic small business needs.

You might think that they have fewer features than the other options but that is not the case. With the Wave Free plan you get:

- Income and expense management and tracking

- Unlimited business accounts and accountants

- Business data dashboard and analytics

- Unlimited invoices

- Credit card and bank payment acceptance

Wave is definitely the best free software for small business accounting needs that you can find.

If you want to upgrade your plan to access the payments (variable pricing) and payroll ($20 per month) features you can get the following:

- 1 business day credit card processing

- Wave payroll solution

- Automatic tax payments to the CRA

Try Wave if you are looking for basic free accounting software.

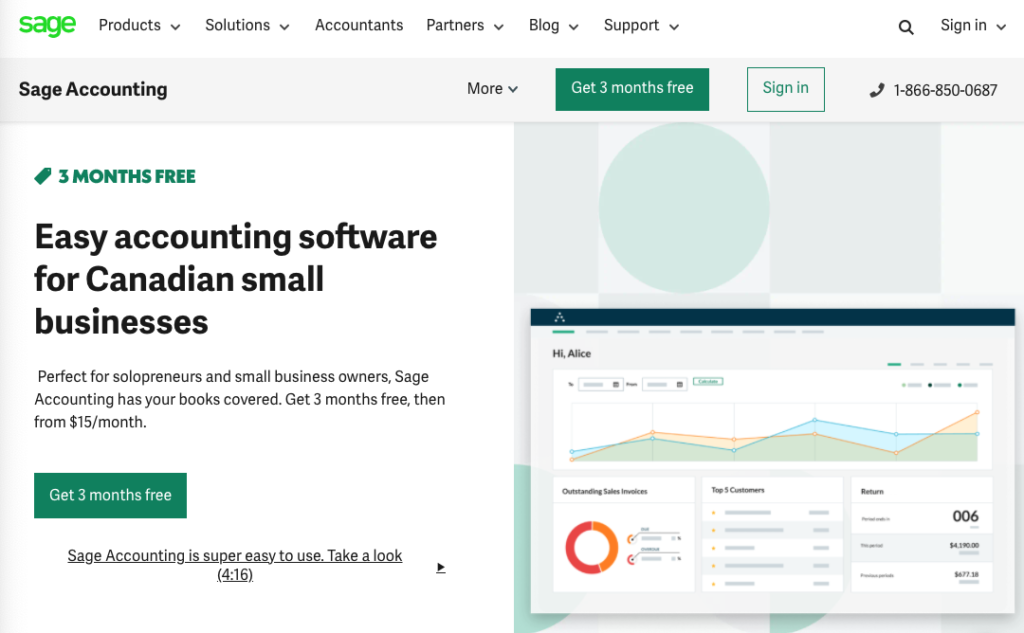

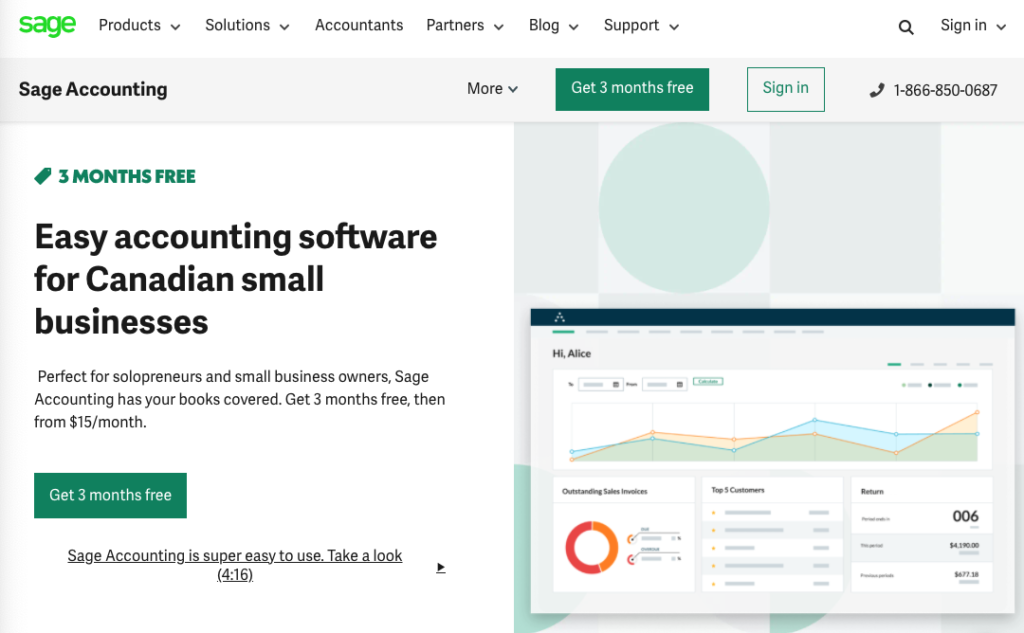

5. Sage Business Cloud Accounting

The Sage Group plc is based in England and is the parent company of Sage Business Cloud Accounting. The company also has a Canadian HQ located in Richmond, BC.

Sage users report easy setup and user experience for both accountants and small business owners. Advanced features are not as strong as the other accounting software platforms but that should be OK for more users.

The Standard plan offers 3 months free and then it is $35.00 per month. It includes:

- Invoicing and accounting software

- Calculate GST/HST to submit to CRA

- English and French language support

- Advanced financial reporting

- Syncing with your bank software

The Plus plan offers more comprehensive accounting solutions like:

- Recurring invoicing

- Cash flow forecasting

- Multi-currency invoicing

Try Sage if you want a mobile friendly accounting software.

Canadian Accounting Software For Small Business Summary

We’re lucky to live in an age of software where tedious and repetitive (but completely necessary) tasks can be outsourced to a computer program.

Accounting is an integral part of any small business in Canada but is not a revenue-driving part of operations. So, it is best to pair accounting software with either a professional bookkeeper or accountant to help you manage your financial statements, tax reporting, and financial analysis.